GOUVERNEMENT DE LA

REPUBLIQUE DU VANUATU

Autorité de Régulation des Services Publics Ministère des Finances

etdela Gestion Economique

Utilities Regulatory Authority | Electricity Tariff Review Tariff Application Report |

|

|

SAC POSTAL PRIVE 9093, PORT-VILA, VANUATU TEL: (678) 23335

March 2010

GOVERNMENT OF THE

REPUBLIC OF VANUATU

Utilities Regulatory Authority

of Vanuatu

Ministry of Finance and Economic Management

PRIVATE MAIL BAG 9093, PORT VILA, VANUATU TEL: (678) 23335

1 Preface

The Utilities Regulatory Authority (the URA) is Vanuatu‟s economic regulator of electricity and water services throughout Vanuatu. The Government of Vanuatu established the Utilities Regulatory Authority on 11 February 2008 under the Utilities Regulatory Authority Act No. 11 of 2007 (the Act).

The URA is responsible for the regulation of certain services in the electricity and water sectors. Our role differs in each regulated industry but generally involves regulating prices, service standards, and market conduct and consumer protection. We also investigate and advise the Government on regulatory matters that affect Vanuatu‟s regulated utilities.

The Act states that our primary objective is to regulate these utilities to ensure the provision of safe, reliable and affordable regulated services and maximise access to regulated services throughout Vanuatu.

The Vanuatu Government has awarded concession contracts for the provision of water and electricity services to a private operator. These contracts delegate the exclusive responsibility for the provision of water and electricity services in Port Vila, and electricity services in Luganville, Tanna Island and Malekula to UNELCO (a subsidiary of the SUEZ Group). The contracts specify rules regarding service coverage, the quality of service to be provided, and the maximum tariffs that may be charged for these services. As the counterparty to each of these contracts, the Government has been responsible for monitoring UNELCO‟s compliance with the contractual provisions.

The Government‟s concern about the high cost of electricity has led to the URA undertaking a full review of the level and structure of tariffs for all concession areas. Under Section 2 paragraph 27 of the Luganville concession agreement and under Section

7.5 of the Port Vila concession agreement, and at the request of the Government, the electricity tariff will be reviewed as more than five years have lapsed since the previous review.

Johnson Naviti Chairperson

1 Preface 2

2 Introduction 5

2.1 Background 5

2.2 Electricity tariff review regulatory framework 6

2.3 Electricity tariff review process 7

2.4 Purpose of this paper 8

2.5 Structure of this paper 8

3 Tariff Setting Methodology 9

3.1 Overview 9

3.2 Demand Forecast 10

3.3 Generation Forecast 10

3.4 Cost Forecast 10

3.5 Regulated Asset Base 13

3.6 Reasonable Return 13

3.7 Base Tariff 14

3.8 Indexation Formula 15

3.9 Tariff Structure 16

4 UNELCO’s Tariff Application Summary 17

4.1 Overview 17

4.2 Demand Forecast 17

4.3 Generation Forecast 18

4.4 Cost Forecast 20

4.5 Regulated Asset Base 22

4.6 Reasonable Return 22

4.7 Base Tariff 24

4.8 Global Efficiency Assumptions 24

4.9 Tariff Structure 24

4.10 Use of Sarakata Savings 25

4.11 Integration of Renewable Energy in the Indexation Formula 25

5 Next Steps 26

Appendix A: Base Assumptions used by UNELCO 27

Appendix B - UNELCO’s forecasts of wind generation 29

Appendix C - UNELCO’s forecasts of hydro generation 31

2 Introduction

2.1 Background

The Utilities Regulatory Authority Act No. 11 of 2007 (the Act) establishes the Utilities Regulatory Authority (the URA) of Vanuatu. The URA is a body corporate with perpetual succession, acting independently from the Government. The URA‟s Commission consists of three Commissioners, a Chairperson and two part-time Commissioners of which one is the Chief Executive Officer of the Authority.

The Act empowers the URA to regulate certain utilities, in particular, the provision of electricity and water services in Vanuatu.

The URA‟s core functions with respect to existing water and electricity utilities include:

Monitoring and enforcing existing concession contracts which include checking monthly price adjustments made by the utility, monitoring service standards and technical performance, reviewing yearly financial reports and auditing operating report processes;

Renegotiating tariffs with the utility in accordance with the relevant concession contracts;

Manage consumer complaints by assisting consumers resolve grievances and/or complaints with the utilities;

Advise Government on utility-related matters as requested; and

Communicating with the Government, utilities, customers and the general public in order to provide information about matters or updates relating to utilities.

The Vanuatu Government has awarded concession contracts for the provision of water and electricity services to a private operator. These contracts delegate the exclusive responsibility for the provision of water and electricity services in Port Vila, and electricity services in Luganville, Tanna Island and Malekula to UNELCO (a subsidiary of the GDF SUEZ Group). The contracts specify rules regarding service coverage, the quality of service to be provided, and the maximum tariffs that may be charged for these services. As the counterparty to each of these contracts, the Government has been responsible for monitoring the utility company‟s compliance with the contractual provisions.

The Act empowers the URA to exercise the functions and powers of the Government relating to the existing concession contracts for electricity and water supply services, which remain unchanged. Policies regarding electricity and water supply continue to be set by the relevant Government ministries and departments.

More than the required five years has lapsed since the previous review and the Government has expressed concern about the high cost of electricity. This has led to the URA undertaking a full review of the level and structure of electricity tariffs for all Concession areas.

Existing concession contracts between the Government and UNELCO provide clear specifications as to when tariff resets can occur. The contracts do not, however, make any provision for the methodology or process to be used for resetting tariffs. This electricity tariff review process conducted by the URA provides guidance for; negotiating the level and structure of consumer tariffs for all current electricity concession contracts.

The URA has commenced a full review of service standards, the cost of, and structure of tariffs for electricity services in Port Vila, Luganville, Tanna Island and Malekula.

Therefore, the URA will:

Develop, in consultation with UNELCO, an approach and methodology for conducting tariff renegotiations now and in the future – to specify the principles, guidelines, process, and financial models needed for reviewing tariffs;

Develop, in consultation with UNELCO, the information needed for an electricity tariff renegotiation, including accounting and technical definitions;

Develop a view as to the reasonableness of service standards for electricity currently specified in the concession contracts, and the possible cost implications of any changes to the service standards, to inform its decision on whether to request changes in service standards in conjunction with any tariff renegotiation;

Review the current costs to develop an estimate of the efficient cost of electricity service in Vanuatu and the associated revenue requirement for the utility;

Assess the impact of alternative generation technologies such as wind, hydro and copra oil costs, revenue requirements and periodic tariff adjustments (due to corresponding variability of diesel volumes and prices);

Review the structure of tariffs for all concessions and determine the impact on consumers from alternative tariff schedules, including differentiated pricing between concession areas; and

Review the tariff adjustment formulae for all concessions and recommend a method of indexation that ensures the viability of the operator and a fair price for consumers.

2.2 Electricity tariff review regulatory framework

Section 20 of the Utilities Regulatory Authority Act No 11 of 2007 sets out that the rights exercisable by the Government in the concession contracts described in Part B of Schedule 1 are assigned to the URA, but may only be exercised by the Authority upon receiving written approval of the relevant Minister.

On 25 March 2009 the URA wrote to the Minister for Lands Geology Mines and Water Resources and the Minister for Infrastructure and Public Utilities seeking approval to commence a review of electricity and water tariffs in Vanuatu.

On 17 June 2009, the Minister for Lands Geology Mines and Water Resources requested the URA to undertake a review of electricity in Vanuatu.

In accordance with sections 5 and 18 of the specification relating to the concession for the generation and supply of electric power in Luganville; sections 5 and 17 of the specification to the concession for the generation and supply of electric power in Port Vila; and article 31 and 32 of the Tanna and Malekula Island concession contract for the generation and public supply of electric power, the URA commenced as part of the tariff review a revision of the base price and of the adjustment formula concerning all concessions and has requested UNELCO‟s assistance in providing the URA with all relevant accounts and statistical statements.

2.3 Electricity tariff review process

In April 2009, the URA published its Electricity Tariff Review Framework Paper inviting interested stakeholders to comment on issues set out in the paper in relation to the process and methodology of the tariff review.

The URA conducted two public consultation workshops to seek further comment on its proposed tariff review approach and methodology. The public consultation workshops were held in Port Vila and Luganville.

In developing its approach and methodology, the URA set out the following process for undertaking the tariff review:

Establishing the methodology for the tariff calculation. The URA establishes the method to be used to calculate the level of the tariff and informs UNELCO;

Tariff application submitted by UNELCO. UNELCO has submitted an application for a level of tariff using the methodology. The application takes the form of a completed financial model and a list of all the assumptions used in the model. The URA will provide a summary of the tariff application in the Electricity Tariff Application Report March 2010 (this document).

URA’s Electricity Tariff Review Position Paper. The URA will respond to the tariff application with its Electricity Tariff Review Position Paper, indicating the assumptions that the URA believes are appropriate for the setting of the tariff. Should these assumptions differ from the tariff application; the areas of difference will be highlighted and further comments provided by the URA. The Electricity Tariff Review Position Paper will also set out the URA‟s recommended tariff formula.

Consultation. The Electricity Tariff Application Report March 2010 and Electricity Tariff Review Position Paper March 2010 will be made available to the public and all interested stakeholders. The URA will invite submissions on its Electricity Tariff Review Position Paper from the public, Government, UNELCO and other interested stakeholders.

URA’s Final Decision & Tariff Recommendation. Following consultation on the URA‟s Electricity Tariff Review Position Paper March 2010, the URA will publish its final recommended tariff. In the event that the final tariff is not agreed between the Government and UNELCO the matter will be referred to arbitration, as specified within the concession agreements. Following agreement on the new tariff level, structure, and formula, the new tariff will take effect upon signing of an addendum to the concession contracts by the Government and UNELCO.

2.4 Purpose of this paper

This paper sets out the approach and methodology for calculating and setting the electricity price for the four UNELCO electricity concessions. As part of this process, UNELCO are required to submit its tariff application to the URA setting out the basis for its proposed electricity tariff. This paper describes UNELCO‟s assumptions set out in its tariff application, including any supporting evidence as provided by UNELCO. .

2.5 Structure of this paper

Section 3 describes the tariff-setting methodology.

Section 4 describes the assumptions used in the tariff application submitted by UNELCO and provides an explanation of these assumptions where provided by UNELCO.

Section 5 describes the next steps of the tariff review process.

Appendix A includes a description of the assumptions provided by UNELCO in calculating their tariff application.

Appendix B sets out UNELCO‟s proposed forecasts for wind generation.

Appendix C sets out UNELCO‟s proposed forecasts for hydroelectric generation. Appendix D sets out UNELCO‟s Letter of Confirmation

3.1 Overview

3 Tariff Setting Methodology

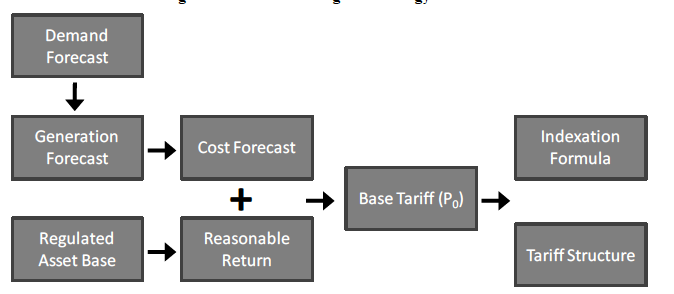

The tariff will be set based on the principle that a fair price for consumers is one where the operator covers the reasonable costs of providing a reasonable level of service and makes a reasonable return. The calculation will be performed using a financial model built by the URA. Figure 3.1.1 below gives an overview of the different elements of the model.

Figure 3.1.1 – Tariff-setting methodology overview

The methodology is applied in the following way:

The Base Tariff (P0) is set at a level to ensure that UNELCO cover the reasonable costs of providing electricity, and earn a reasonable return on the capital they have invested in electricity infrastructure.

The Cost Forecast is based on predictions of the costs associated with providing a forecast level of generation, in order to meet the forecast demand.

The level of capital invested in electricity is referred to as the Regulated Asset Base (RAB). The tariff is set to ensure UNELCO earn a reasonable level of return on capital they have invested in this asset base. The reasonable rate of return is estimated as the weighted average cost of capital (WACC).

The Indexation Formula allows the passing through of some external cost changes to electricity customers, for example fuel, wage, and materials cost inflation. The price calculated each month using the Indexation Formula is referred to as P.

The Tariff Structure creates the final electricity prices that will be paid by the different groups of customers for fixed monthly fees and per kWh based on the price P.

The methodology has been designed to calculate a price for five calendar years from 2010 to 2014. Each of the elements shown above is described in detail in the following sections 3.2 to 3.9.

3.2 Demand Forecast

The Demand Forecast estimates electricity consumption in the four concessions for the period 2010 to 2014. The level of demand determines the amount of electricity that needs to be produced, which in turn determines the fuel cost of producing that level of electricity. Also, the level of demand determines the revenue that UNELCO will earn. The bills that customers pay depend on the number of kWh consumed in a month, and the kVA rating of their connection. The Demand Forecast is made up of monthly forecasts of kWh and kVA by concession by customer group (see section 3.9 for a description of existing customer groups). Forecasts are created by estimating annual percentage (%) growth for each concession and consumer group.

3.3 Generation Forecast

The Generation Forecast predicts how power will be generated to meet the estimated demand. Each concession has different generation sources:

Table 3.3.1 – Generation sources by concession

Concession area | Generation sources (capacity, megawatts) |

Port Vila | Port Vila diesel (9.22 MW) Tagabe diesel/copra (11.2 MW) Wind farm (3.025 MW) |

Luganville | Luganville diesel (2.9 MW) Sarakata hydro (1.2 MW) |

Malekula | Diesel/copra plant (400 kW) |

Tanna | Diesel plant (440 kW) |

For each concession, a forecast is made for how each of the generation sources will be used to meet the forecast demand. For the renewable sources (wind in Port Vila and hydro in Luganville), a forecast is created using the available historic information. The renewable sources are assumed to be used first to meet demand. The remaining power requirements are assumed to be generated from fuel-based sources. A fuel mix of diesel and copra is estimated, along with estimated fuel efficiency of the diesel and copra generators. This is used to calculate the amount of fuel required.

3.4 Cost Forecast

The Cost Forecast estimates the reasonable costs of providing electricity services in the four concession areas. Fuel costs are calculated on a monthly basis from the Generation Forecast. All other costs are calculated on an annual basis and forecasted over the 5 year concession period.

The different areas of costs considered are shown in the following subsections.

3.4.1 Fuel costs

The Generation Forecast estimates the amount of diesel and copra required to meet the forecast electricity consumption. By forecasting prices of diesel and copra, it is then possible to estimate the cost of fuel. The global price of fuel is highly volatile, so the Indexation Formula is designed to adjust the price of electricity to allow UNELCO to cover the reasonable cost of fuel.

The Fuel Cost also includes a “Theoretical Diesel Cost” for the full amount of the Sarakata savings as defined in the Addendum to the Luganville concession for the handing over of the Sarakata Hydro plant.

3.4.2 Staff costs

Staff costs are the wage and salary costs of staff, and the labour related on-costs directly incurred in the provision of electricity. The Indexation Formula is also designed to adjust the price of electricity for changes in general wage levels.

In order to avoid double-counting, the allowance for staff costs for running the Sarakata hydro plant should be subtracted from the forecast of staff costs. Under section 22 of the Addendum to the Luganville concession agreement regarding the handing over of the Sarakata hydro plant, the amount set out for staff costs for running the Sarakata hydro plant is 10m vatu.

This is deducted from the Staff costs as these costs are included in the Theoretical Diesel Costs for Luganville.

3.4.3 Goods and other purchases

Goods and other purchases includes all other current costs other that fuel and staff costs, incurred in the provision of electricity. The Indexation Formula is also designed to adjust the price of electricity for changes in general goods prices.

In order to avoid double-counting, the allowance for maintenance and miscellaneous costs for running the Sarakata hydro plant should be subtracted from the forecast of goods and other purchases costs. Under sections 21 and 23 of the Addendum to the Luganville concession agreement regarding the handing over of the Sarakata hydro plant, the amount stipulated for maintenance and miscellaneous costs for running the Sarakata hydro plant 4m and 6m vatu respectively.

This is deducted from Goods and other purchases as these costs are included in the Theoretical Diesel Costs for Luganville.

3.4.4 Taxes

UNELCO pays no corporate profit taxes but does pay other duties taxes and levies. Where theses are incurred in the provision of electricity they form part of UNELCO‟s costs.

3.4.5 Provisions

Provisions are estimates of costs that may occur in the future and where they are reasonably incurred in the provision of electricity form part of UNELCO‟s costs. Provisions related to the production of electricity include:

- Provisions pour indemnités de fin de carrière (Provision for pensions)

- Provisions pour cas de force majeure (Provisions for force majeur events)

- Provisions pour dépréciation des créances (Provision for account receivable depreciation)

- Provisions pour dépréciation des stocks (Provision for depreciation of stocks).

- Provision pour renouvellement – autres (Provision for renewal – other, as specified in Section 5 of the concession agreement)

In order to avoid double-counting, the allowance for the provision for renewal of the Sarakata hydro plant should be subtracted from the forecast of provisions. Under sections 8 and 26 of the Addendum to the Luganville concession agreement regarding the handing over of the Sarakata hydro plant, the amount stipulated for the provision for renewal is 10m vatu.

This is deducted from provisions as this is included in the Theoretical Diesel Costs for Luganville.

3.4.6 Depreciation & Caducité

Section 4, 7 and 8 of the concession agreement defines how depreciation will be calculated in UNELCO‟s accounts and thus how it is treated in the tariff review. Deprecation method and inclusion in costs is dependent on the type of asset:

- Infrastructure assets (Concession Fixed Assets) financed by the concessionaire are to be depreciated on an „asset transfer‟ basis (concession accounting)

- Infrastructure assets financed by third parties are not depreciated at all

- Private assets are to be depreciated by applying coefficients specified in the concession contract

- Intangible assets are not included in estimating the reasonable cost of service.

Depreciation of assets required to operate the concession is included at re-evaluated cost value in the Cost Forecast.

3.4.7 Sarakata savings

The 1995 addendum to the Luganville concession contract for the handing over of the Sarakata hydro plant to UNELCO specifies that the fuel savings resulting from generation electricity with the hydro plant should be used to cover the running costs of the hydro plant and the remainder held in the Sarakata Special Reserve Fund.

The method of calculating the savings is specified in the addendum. These savings are included in the Fuel costs as “Theoretical Diesel Cost” for Luganville. The addendum also specifies how the costs of running the hydro plant are calculated. They are:

4m vatu for maintenance (Section 21) 10m vatu for personnel (Section22)

6m vatu for miscellaneous costs (Section 23)

10m vatu for a provision for renewal of the hydro plant. (Section 26)

Each of these amounts is deducted from the Cost forecast as described in the subsections above so as to avoid double-counting.

3.4.8 Costs not related to regulated services

Costs included in UNELCO‟s profit and loss statement (P&L) but excluded from the tariff calculation are as follows:

Production Immobilisée. In UNELCO‟s accounts, the costs of investment in the network are included in the cost side of the P&L statement. UNELCO are compensated for these costs through depreciation and the return on their assets. The value of these costs also included in the revenue side of UNELCO‟s P&L as “Production immobilisée”. This value is deducted from the Cost Forecast in order to avoid double-counting.

Production Vendue. UNELCO include the costs of building extensions and other works in the P&L. These costs are recovered from customers. This revenue is included in the P&L as “Production Vendue”. The revenue figure is deducted from costs, subject to a 3% assumed profit for UNELCO.

Intérêts et Charges Assimilés. Interest charges are removed to avoid double-counting as they are covered in the Reasonable Return on assets.

Reprise sur provision. Where costs have been met by taking money from provision funds, this amount is deducted from costs to avoid double-counting.

3.5 Regulated Asset Base

The Regulated Asset Base represents the level of investment held by the operator in assets required to provide electricity generation, transmission, distribution and supply. This is calculated as the Net Book Value of all concessionaire-funded concession assets, plus any private assets owned by the operator that are necessary for the provision of electricity. It does not include any intangible assets, assets funded by third parties, financial assets or works in progress.

The method of valuing concession assets is specified in Section 8 of the concession contracts. The concession agreements specify that the assets be re-valued annually according to the index of “Matériel” published in the “Journal Officiel” (New Caledonia Gazette) in the series of costs of construction materials (reference 28IM).

3.6 Reasonable Return

One of the primary aims of the methodology is to allow for a reasonable return on investment in the concession. This creates the incentive for further investment in expanding electricity supply in Vanuatu. This reasonable return is set to be equal to an estimate of a reasonable cost of capital for the concession. This also incentivises the operator to raise capital efficiently, as there is a financial benefit of minimising capital costs.

The method of estimating a reasonable Weighted Average Cost of Capital (WACC) is described in sections 3.6.1 and 3.6.2.

3.6.1 Weighted Average Cost of Capital (WACC)

The WACC is applied to the Regulated Asset Base (RAB) to calculate the value of the reasonable return.

Capital can be raised in two ways: through debt or equity. Both methods have an associated cost

– interest payments and dividends respectively. The level of cost for each type of capital is influenced by the perceived riskiness of the investment: the higher the risk, higher returns must be offered to sources of capital, resulting in a higher cost of capital. The process of determining a reasonable return estimates the appropriate return for each source of capital. The cost of capital is weighted by their respective contributions to the total capital base.

where

Re = return on equity capital Rd = return on debt capital

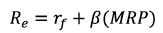

The method of estimating the appropriate returns from each type of capital is the Capital Asset Pricing Model (CAPM), explained below.

3.6.2 Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) provides an estimate of the required return for risky assets as the sum of the return from risk-free assets and an appropriate risk premium. The calculation is slightly different for debt and equity:

Cost of Equity

where

Re = required return on equity

Rf = the risk free rate of return is the return an investor could reasonably expect if they invested their money in a riskless investment. As the market rarely offers a riskless investment, a proxy for the risk free rate is applied

β = is the scaling factor beta (β) to be applied to the market risk premium, it measures the volatility of the specific assets relative to the entire market. If the assets are more volatile than the market average, then the beta to be applied is greater than one

MRP = the market risk premium is the rate of return earned on a well-diversified portfolio of assets over the risk free rate for a business similar to the business in question

Cost of Debt

where

Rd = required return on debt Rf = is the risk free

DRP = is the Debt Risk Premium based on the credit risk of the debt for a business similar to the business in question

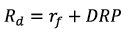

3.7 Base Tariff

The Base Tariff is set at a level where the operator earns revenue from electricity sales equal to the Cost Forecast plus a Reasonable Return. It is calculated as an average over five years, assuming constant input prices (fuel, wages, and materials)

The Base Tariff is calculated by:

- Forecasting the Total Demand (kWh and kVA)

- Applying the WACC to the Regulated Asset Base to give the Reasonable Return

- Adding the Reasonable Return and Costs to give a Total Required Revenue

- Divide Total Required Revenue by the forecast Total Demand to give the Base Tariff value of P0.

The Base Tariff is referred to as P0. This is used in the tariff indexation formula to calculate the price of electricity each month. The monthly calculated price is referred to as P (not to be confused with P0), and is used with the Tariff Structure to set the prices paid by customers. The indexation formula is described in the section 3.8.

3.8 Indexation Formula

The purpose of the indexation formula is to allow fluctuations in certain input prices (fuel, wages and materials) to be passed through to electricity customers. This is so that UNELCO can collect sufficient revenue to supply electricity services should input prices increase, and also that customers can benefit when input prices fall.

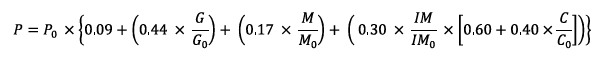

Figure 3.8.1 – Indexation components

The current structure of the indexation formula is shown in Figure 3.8.1. Ideally the coefficients should match UNELCO‟s cost structure.

The current tariff indexation formula, as set out in the Addendum Varying the Tariffs (2007) in the Port Vila electricity concession agreement is:

UNELCO were not requested to submit revised weights of the tariff formula as part of the tariff application. Revised weights of the tariff formula will be proposed in the Electricity Tariff Review Position Paper March 2010 which will be published by the URA as the next step of the Tariff Review process. Submissions will then be requested in response to the proposal.

3.9 Tariff Structure

The tariff structure defines the prices charged to different customer groups, based on the monthly price P. Table 3.9.1 shows the current tariff structure.

Table 3.9.1 – Current Tariff Structure

Customer group | Price per kWh | Monthly fixed charge | Security deposit |

Small Domestic Consumers | Up to 60 kWh = 0.62 x P 61 to 120 kWh = 0.93 x P Over 120 kWh = 1.70 x P | None | 70 x P |

Business Licence Holders – Low Voltage | 0.87 x P | 20 x P per subscribed kVA | 150 x P per subscribed kVA |

Sports Fields | 1.00 x P | None | None |

Public Lighting | 0.54 x P | None | None |

Other Low Voltage Users | 0.96 x P | 19 x P per subscribed kVA | 150 x P per subscribed kVA |

High Voltage Users | 0.70 x P | 25 x P per subscribed kVA | 150 x P per subscribed kVA |

The current tariff structure is set out in Section 5 of the Specifications (1986) and section 7 of the 1997 Addendum of the Port Vila concession agreement.

4 UNELCO’s Tariff Application Summary

4.1 Overview

On 24 February 2010 UNELCO submitted its tariff application to the URA. The application included a base scenario and UNELCO‟s efficiency assumptions. The base scenario sets out UNELCO‟s proposed forecasts of demand, generation, costs, and asset levels from 2010 to 2014. The efficiency assumptions consist of a net saving from operating and technical efficiencies. UNELCO propose as part of its submission that the Sarakata Special Reserve Fund be used to reduce the overall tariff, and also that there be a more significant reduction of tariffs for its low income customers.

The following sections describe UNELCO‟s assumptions as set out in its tariff application, including supporting evidence where it has been provided.

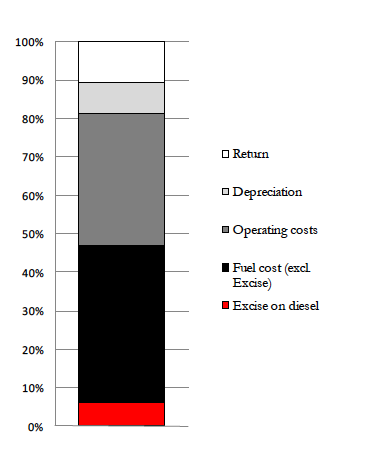

Figure 4.1.1 – Breakdown of revenue from tariff

The revenue generated by the tariff must cover the reasonable costs of providing electricity services in Vanuatu, and a return that covers the reasonable cost of capital.

The relative proportions of the major areas of cost (fuel costs, operating costs, and depreciation) and the return in the base scenario of UNELCO‟s tariff application are shown in Figure 4.1.1.

4.2 Demand Forecast

UNELCO‟s revenue from electricity has several components. Each component is described below, with the assumptions that UNELCO have used to forecast each part of demand.

4.2.1 Kilowatt-hour (kWh) Demand

UNELCO proposed forecast demand across all concessions to be 3.2% per annum. This forecast is based on a discounted 10-year geometric average growth rate for all of the UNELCO concessions. UNELCO expects the next five years growth to be slightly lower than the previous

ten years (+ 3.59 %) due to the global economic situation, as well as an extension of perimeter during the last 10 year period considered. For the year 2009 a 3.25% increase was recorded. The same growth rate is assumed for all consumer groups and all concessions.

4.2.2 Kilovolt-amp (kVA) Demand

Most categories of customers, except small domestic customers has a rating in kVA. For customers in the Industrial, Commercial, and Low Voltage (Other) categories, the monthly fixed charge is proportional to the rating of their connection in kVA. Demand growth in kVA is forecast the same way as for kWh.

Demand growth in kVA across all concessions is forecast to be 3.2%, the same as for kWh growth. The same growth rate is assumed for all consumer groups and all concessions.

4.2.3 Power Factor (Cos Phi) Charges

Cos Phi charges are penalties on industrial customers who achieve a power factor of less than 80%. UNELCO would like to retain the incentive for customers to improve their power factors. UNELCO have assumed that the revenue from these charges will remain constant for the next five years.

4.2.4 Prime de transfo

Prime de transfo is revenue paid by high voltage customers to rent a transformer from UNELCO, rather than have their own private transformer. UNELCO assume the growth in Prime de transfo to be in line with the 10 year average growth, which is 0.36% for Port Vila, and 2.07% in Luganville. There is no Prime de transfo revenue in Malekula or Tanna.

4.3 Generation Forecast

4.3.1 Port Vila

Generation capacity in Port Vila comprises diesel/copra plant at Tagabe, diesel plant in Port Vila, and the wind farm at Devil‟s Point. UNELCO have estimated the amount of power generated by the wind farm, and have estimated the amount of copra oil that will be used in the Tagabe generator. UNELCO have assumed that power generated by diesel will make up the difference between total gross power required (total demand plus forecast losses) and power generated by wind and copra oil.

The amount of power generated by the wind farm is assumed to be 4,600,000 kWh per annum from 2010 to 2012, and 6,600,000 kWh from 2012 to 2014. For a full explanation of this assumption, see Appendix B: Estimated Annual Energy Yield – Wind.

The diesel fuel efficiency across the Tagabe and Port Vila generators is assumed to be 0.259 litres per kWh.

For the purposes of the forecast, the cost of diesel is assumed to be constant at 85 vatu per litre from 2010 to 2014. The impact on costs of variations of fuel prices will be dealt with in more detail in the design of the Indexation Formula, which will be included in the URA‟s Electricity Tariff Review Position Paper.

Copra oil is used in the Tagabe generator. The forecast use of copra oil in Port Vila is shown in Table 4.2.2.1 below:

Table 4.3.1.1 Forecast copra oil consumption in Port Vila

Year | Copra consumption, litres |

2010 | 750,000 |

2011 | 1,400,000 |

2012 to 2014 | 2,500,000 |

The efficiency of copra in the Tagabe generator is assumed to be 0.294 litres per kWh.

For the purposes of the forecast, the cost of copra oil is assumed to be constant at 100 vatu per litre from 2010 to 2014. The impact on costs of variations of fuel prices will be dealt with in more detail in the design of the Indexation Formula, which will be included in the Electricity Tariff Review Position Paper March 2010.

Losses are calculated as the difference between the electricity generated (gross energy) and the amount of electricity invoiced to customers. UNELCO have included un-invoiced energy in their losses amount. Losses are forecast to be at the same level as 2009.

4.3.2 Luganville

Generation capacity in Luganville comprises the diesel generator at Luganville, and the Sarakata hydroelectric plant. UNELCO have estimated the power generated by the Sarakata hydro plant. UNELCO have assumed that power generated by fuel will make up the difference between total gross power required (total demand plus forecast losses) and power generated by the Sarakata hydro plant.

The amount of power generated by the Sarakata hydro plant is assumed to be 5,614,000 kWh per annum from 2010 to 2014. For a full explanation of this assumption, see Appendix C: Estimated Annual Energy Yield – Hydro.

As set out in the Addendum to the Contract of Concession for the Generation of Public Supply of Electric Power in Luganville relating the handing over of the Sarakata Hydroelectric Power Station, UNELCO must set aside the fuel savings from running the hydro plant. The method of calculating these savings is set out in the addendum. For the purposes of calculating the Sarakata savings, the price of diesel is assumed to be 85 vatu per litre, and the price of lubricant oil is assumed to be 256.40 vatu per litre.

The diesel fuel efficiency for the Luganville diesel generators is assumed to be 0.286 litres per kWh.

For the purposes of the forecast, the cost of diesel is assumed to be constant at 85 vatu per litre from 2010 to 2014. The impact on costs of variations of fuel prices will be dealt with in more detail in the design of the Indexation Formula, which will be included in the Electricity Tariff Review Position Paper March 2010.

Losses are calculated as the difference between the electricity generated (gross energy) and the amount of electricity invoiced to customers. UNELCO have included un-invoiced energy in their losses amount. Losses are forecast to be at the same level as 2009.

4.3.3 Malekula

Generation capacity in Malekula comprises the diesel/copra generator. UNELCO have converted the generator to be able to run on 100% copra oil. The forecast of power generated is calculated as total demand plus losses.

The copra oil fuel efficiency for the Malekula generator is assumed to be 0.414 litres per kWh. In case any diesel is used in Malekula, the diesel fuel efficiency is assumed to be 0.357 litres per kWh.

For the purposes of the forecast, the cost of copra oil is assumed to be constant at 100 vatu per litre from 2010 to 2014. The impact on costs of variations of fuel prices will be dealt with in more detail in the design of the Indexation Formula, which will be included in the Electricity Tariff Review Position Paper March 2010.

Losses are calculated as the difference between the electricity generated (gross energy) and the amount of electricity invoiced to customers. UNELCO have included un-invoiced energy in their losses amount. Losses are forecast to be at the same level as 2009.

4.3.4 Tanna

Generation capacity in Tanna comprises the diesel generator. The forecast of power generated is calculated as total demand plus losses.

The diesel fuel efficiency for the Tanna generator is assumed to be 0.364 litres per kWh.

For the purposes of the forecast, the cost of diesel is assumed to the constant at 85 vatu per litre plus a freight charge of 20.5 vatu per litre from 2010 to 2014. The impact on costs of variations of fuel prices will be dealt with in more detail in the design of the Indexation Formula, which will be included in the Electricity Tariff Review Position Paper March 2010.

Losses are calculated as the difference between the electricity generated (gross energy) and the amount of electricity invoiced to customers. UNELCO have included un-invoiced energy in their losses amount. Losses are forecast to be at the same level as 2009.

4.4 Cost Forecast

The Cost Forecast consists of several cost elements: Fuel Costs, Staff Costs, Other Costs, and Depreciation. UNELCO have provided forecasts for each of these. The trends in the different categories of costs are described below, with UNELCO‟s explanation where it has been provided.

4.4.1 Fuel Costs

Fuel costs are calculated based on the Generation Forecast described above. The amount of power generated by each type of plant is forecast. Using assumptions of fuel efficiency, an estimate of the amount of fuel is calculated. The fuel cost is calculated using a forecast of the price of fuel per litre.

Table 4.4.1.1 – Fuel efficiency assumption per generator and fuel type

Generator – Fuel type | Assumed fuel consumption, litres/kWh |

Port Vila – Diesel | 0.259 |

Port Vila – Copra | 0.294 |

Luganville – Diesel | 0.286 |

Malekula – Diesel | 0.357 |

Malekula – Copra | 0.414 |

Tanna – Diesel | 0.364 |

The Tariff Indexation formula will be used to take fuel price fluctuations into account.

Table 4.4.1.2 – Fuel price assumptions used in the Base Scenario

Fuel type / Concession | Assumed fuel price per litre, vatu |

Diesel / Port Vila & Luganville | 85 |

Diesel / Malekula | 85 plus 14.5 transport and fees |

Diesel / Tanna | 85 plus 20.5 transport and fees |

Copra / All | 100 |

4.4.2 Staff Costs

UNELCO have provided forecasts of staff costs from 2010 to 2014 for each electricity concession. The average annual change from 2009 levels to 2014 in forecast staff costs is shown in the table below.

Table 4.4.2.1 – Average forecast annual change in staff costs 2009-2014

Concession | Average annual staff cost change 2009-2014, % |

Port Vila | +2.4% |

Luganville | +3.6% |

Malekula | -1.7% |

Tanna | +3.1% |

Total | +2.6% |

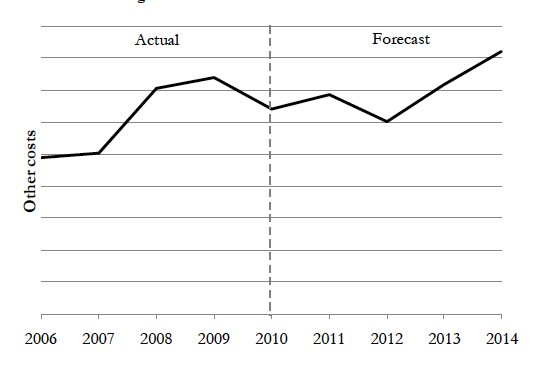

4.4.3 Other Costs

Other costs included in UNELCO‟s Tariff Application are:

- Goods & materials purchased

- Purchases non-stocked (e.g. sub-contracting)

- Taxes

Costs not related to regulated services described in section 3.4.8 above are deducted from this area of costs.

The forecast level of these costs is shown in Figure 4.4.3.1.

Figure 4.4.3.1 – Forecast trend in other costs

4.4.4 Depreciation

The method of accounting for depreciation and asset write-downs (Caducité) is defined in the concession contract, and is described in section 3.4.6. UNELCO have provided forecasts of this depreciation for 2010 to 2014.

4.5 Regulated Asset Base

The Regulated Asset Base is the value of the concessionaire-funded assets for electricity distribution. This is calculated as the Net Book Value of all concessionaire-funded concession assets, plus any private assets owned by the operator that are necessary for the provision of electricity. It does not include any intangible assets, assets funded by third parties, financial assets or works in progress. The method of valuing these assets is specified in the concession contracts.

UNELCO have provided forecasts of the value of these assets from 2010 to 2014.

4.6 Reasonable Return

The method of estimating a reasonable return to be included in the tariff is described in section

3.6. UNELCO‟s assumptions to calculate an appropriate Weighted Average Cost of Capital (WACC) are shown in Table 4.6.1.1.

Table 4.6.1.1 – UNELCO’s WACC assumptions

WACC Component | Assumption, % |

Nominal risk free rate | 4.00% |

Market risk premium | 5.00% |

Country risk premium | 6.00% |

Market rate of return | 15.00% |

| |

Corporate tax rate | 0.00% |

Gearing | 40% |

Equity proportion | 60% |

Rate of imputation credit utilisation | 50.00% |

Inflation rate | 4.7% |

| |

Return on equity calculations | |

Nominal risk free rate | 4.00% |

Market risk premium | 5.00% |

Country risk premium | 6.00% |

Market rate of return | 15.00% |

Asset beta | 0 |

Debt Beta | 0 |

Equity beta | 1.00 |

Return on equity (before imputation) | 15.00% |

| |

Return on debt calculations | |

Risk premium | 6.00% |

Return on debt (pre-tax) | 10.00% |

| |

Post-tax nominal WACC | 13.00% |

| |

Post tax real | 7.93% |

Pre-tax nominal | 13.00% |

Pre-tax real | 7.93% |

4.7 Base Tariff

Using the assumptions described above to create a Demand Forecast, Generation Forecast, Cost Forecast, Regulated Asset Base, and Reasonable Return, UNELCO have estimated a “Base Scenario” base price (P0).

This is then adjusted according to efficiency assumption described in section 4.8.

4.8 Global Efficiency Assumptions

UNELCO have provided an estimate of the amount of administrative and technical efficiencies that can be achieved from 2010 to 2014. The proposed efficiency savings relative to the base scenario forecasts are shown in Table 4.8.1.

Table 4.8.1: UNELCO’s estimated operating efficiencies per annum

2010 | 2011 | 2012 | 2013 | 2014 | Total |

98,495,643 | 142,460,919 | 164,349,618 | 185,560,998 | 193,254,746 | 784,121,924 |

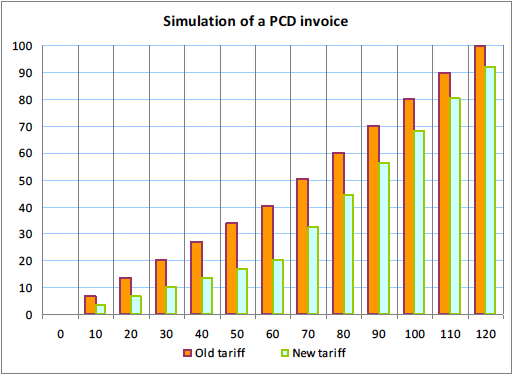

4.9 Tariff Structure

As part of their tariff application, UNELCO has put forward an adjustment to the Small Domestic Customer tariff structure shown in Figure 4.9.1.

The proposed structure contains significant reduction of 50 % for customers consuming less than 60 kWh each month, and a higher tariff for consumption from 60-120 kWh each month.

Figure 4.9.1: UNELCO’s proposed changes to the Small Domestic Customer tariff

4.10 Use of Sarakata Savings

UNELCO proposes to incorporate all of the savings generated by the Sarakata hydro plant into a lower tariff for all electricity customers. UNELCO‟s suggestion in this area is noted.

4.11 Integration of Renewable Energy in the Indexation Formula

UNELCO proposes to integrate the impact of non-storable, renewable energy (wind, solar, hydroelectric) into the indexing formula for P. This amendment would establish a weighting factor that takes into account the ratio of diesel/copra output to total output (diesel/copra and renewable).

Every customer in all the concessions areas will thus benefit from the reduction of costs due to the use of renewable energy instead of gas oil, whatever the source and location (Hydro in Luganville, wind in Port Vila, geothermal in Efate for example)

Et - is the total gross output from all sources

Eenr - is the total gross output of all renewable sources (wind, solar, hydroelectric).

UNELCO propose that the new P0 to apply to the indexing formula will be calculated assuming 0% renewables.

5 Next Steps

This report sets out the methodology used to calculate the new tariff and describes UNELCO‟s tariff application, including UNELCO‟s assumptions and basis for its proposed tariff level, structure and formulae.

The next steps in the process are:

URA Electricity Tariff Review Position Paper -. The URA in response to UNELCO‟s tariff application has /will publish its Electricity Tariff Review Position Paper, setting out the URA‟s initial assumptions for the setting of the tariff. Should these assumptions differ from the tariff application, the areas of difference will be highlighted and further comments provided by the URA

Consultation. The Electricity Tariff Application Report March 2010 and Electricity Tariff Review Position Paper March 2010 will be made available to the public and all interested stakeholders. The URA will invite submissions on the position paper from the public, Government departments, UNELCO and all other stakeholders.

URA’s Final Decision & Tariff Recommendation. Following consultation on the URA‟s Electricity Tariff Review Position Paper March 2010, the URA will publish its final recommended tariff. In the event that the final tariff is not agreed between the Government and UNELCO the matter will be referred to arbitration, as specified within the concession agreements. Following agreement on the new tariff level, structure, and formula, the new tariff will take effect upon signing of an addendum to the concession contracts by the Government and UNELCO.

Appendix A: Base Assumptions used by UNELCO

Type | Concession | Metric | Assumption | Comments |

Demand Forecast | | | | |

Demand Forecast | All | kWh demand growth annual growth rate 2010 to 2014 | 3.2% | |

Demand Forecast | All | kVA demand annual growth rate 2010 to 2014 | 3.2% | |

Demand Forecast | All | Revenue growth from COS PHI 2010 to 2014 | 0% | |

Demand Forecast | All | Revenue from Raccords Transfo annual growth rate 2010 to 2014 | 3.2% | |

Generation Forecast | | | | |

Generation Forecast | Port Vila | Wind generation 2010-2011 | 4,600,000 kWh | See Appendix B |

Generation Forecast | Port Vila | Wind generation 2012-2014 | 6,600,000 kWh | See Appendix B |

Generation Forecast | Port Vila | Diesel plant fuel efficiency | 0.259 litres per kWh. | |

Generation Forecast | Port Vila | Diesel price 2010 - 2014 | 85 VUV per litre | |

Generation Forecast | Port Vila | Port Vila Annual Coprah consumption 2010 to 2014 | 2010 : 750 000 litres , 2011 : 1 400 000 litres, 2012 : 2,500,000 litres | |

Generation Forecast | Port Vila | Copra fuel efficiency | 0.294 litres per kWh. | |

Generation Forecast | Port Vila | Copra price 2010 - 2014 | 100 VUV per litre | |

Generation Forecast | Port Vila | Monthly system losses (kWh sold / kWh produced) | Same as 2009 | |

Generation Forecast | Luganville | Annual hydro generation 2010 to 2014 | 5,614,000 kWh per annum | See Appendix C |

Generation Forecast | Luganville | Price of lubricant oil (used in Sarakata fund savings calculation) | 256.40 VUV per litre | |

Generation Forecast | Luganville | Diesel plant fuel efficiency | 0.286 litres per kWh | |

Generation Forecast | Luganville | Diesel price 2010 - 2014 | 85 VUV per litre | |

Generation Forecast | Luganville | Monthly system losses (kWh sold / kWh produced) | Same as 2009 | |

Generation Forecast | Malekula | Copra plant fuel efficiency | the Malekula generator is assumed to be 0.414 litres per kWh for coprah. | |

Generation Forecast | Malekula | Copra consumption | 100 % production coprah | |

Generation Forecast | Malekula | Copra price 2010 - 2014 | 100 VUV per litre | |

Generation Forecast | Malekula | Monthly system losses (kWh sold / kWh produced) | Same as 2009 | |

Generation Forecast - Tanna | Tanna | Diesel plant fuel efficiency | 0.364 litres per kWh. | |

Generation Forecast - Tanna | Tanna | Diesel price | Port Vila price plus 20.5 VUV per litre | |

Generation Forecast - Tanna | Tanna | Monthly system losses (kWh sold / kWh produced) | Same as 2009 | |

Cost Forecast | | | | |

Cost Forecasts | Port Vila | Staff Cost 2010- 2014 | Increase 2.4% over this period | |

Cost Forecasts | Luganville | Staff Cost 2010- 2014 | Increase 3.6% | |

Cost Forecasts | Luganville | Sarakata savings calculation | Theoretical diesel & lubricant cost based on Sarakata savings formula added to fuel cost for Luganville. 10m removed from staff cost for Luganville. 6m + 4m removed from Goods & Other costs for Luganville | |

Cost Forecasts | Malekula | Staff Cost 2010- 2014 | Decrease 1.7% | |

Cost Forecasts | Tanna | Staff Cost 2010- 2014 | Increase 3.1% | |

Cost Forecasts | All | Other Costs 2010- 2014 | Change in average cost per kWh, 2006-2009 to 2010-2014 | |

Reasonable Return | | | | |

Reasonable Return | All | Nominal risk free rate | 4% | |

Reasonable Return | All | Market risk premium | 5% | |

Reasonable Return | All | Country Risk Premium | 6% | |

Reasonable Return | All | Gearing | 40% | |

Reasonable Return | All | Equity proportion | 60% | |

Reasonable Return | All | Inflation rate | 4.7% | |

Reasonable Return | All | Equity beta | 1 | |

Reasonable Return | All | Debt risk premium | 1% | |

Appendix B - UNELCO’s forecasts of wind generation

This document was prepared by UNELCO and sent to the URA on the 27 October 2009.

Background

A measurement tower was installed on the plateau Kawena in May 2004. A study by Winergy with 17 months of measurements (05/05 to 10/06) calculated a net energy yield of 619 000 kWh/ year for a GEVMP 275kW placed at the location of the pole position.

A wind turbine was then installed next to the location of the measurement tower measurement. The results of operating the wind turbine from June 2007 to October 2008, was an estimate average energy yield of 471 000 kWh / year.

An additional 10 turbines were commissioned in November 2008. With operation of 11 wind turbines up to September 2009 an estimate average energy yield of 312 000 kWh / year per turbine or 3 433 000 kWh / year for 11 windmills is obtained.

Limitations to Estimates

Measurements during the study period are not representative. It seems the measurements were made in a very windy year. The correlation with measurements of the station at Bauerfield could not be established, making it difficult to forecast estimates for the years to come.

This study calculates the energy yield for a single wind turbine placed at the location of the measurement tower. It is likely that the expected wind, or the performance of the machine are lower than expected.

The production of each of the 11 turbines is less than that of a single wind turbine placed on the site, due to the effects of wake (interference). Also the additional 10 wind turbines are placed at different heights and positions vis-à-vis the cliff edge.

Experience So Far

Given the new installation and experience of the team, other factors beside wind also impacted the output of the of 11 wind turbines.

Testing the anticyclone mechanism and renewing the hydraulic systems – all machines were out of service for 1 week

Damage due to lightning on the turbine 3 – out of service for 2 months

Electrical fault on the system pitch of the turbine 4 - out of service for 1/2 a month Failure on the gearbox of the turbine 13 - out of service for 1 month

6 months maintenance of turbines was badly organized - unavailable for 1 additional week for 5 turbines.

Twisting of the nacelle on turbine 10 - out of service for 2 months

Problem with the gearbox of the wind turbines 3 and 8 - out of service for 1 week

Forecasted Wind Production

To correct for the above factors, we have made the following assumptions:

Compared to the actual results of the operation of turbines, we believe that the average value of producible estimated by Winergy must be reduced by 25%.

Given the differences in production of turbine 7 before and after implantation of 10 other machines, we consider the effects of cross wind wake decreases production by 5%.

The average expected energy yield is thus 4 600 000 kWh / year for the entire wind farm (11 turbines). The annual average production may vary +/- 15% depending on the year .We can therefore expect an annual energy yield between 3 900 000 kWh and 5 300 000 kWh.

The weather data station at Bauerfield suggests that the average wind speed for the last 3 years is lower than the average over the past 25 years. These values are calculated from measurements made off every 3 hours, and measured at a site significantly different from the wind. It is not possible to use them to calculate a producible but we can still be used as an indicator.

Appendix C - UNELCO’s forecasts of hydro generation

This document was prepared by UNELCO and sent to the URA on the 27 October 2009.

Estimated Production for the Santo Hydro

The Santo hydro consists of:

2 x 300 kilowatts asynchronous machine

1 x 600 kilowatts synchronous machine

This is supplemented by diesel generators: 2 x 1000 kW

1 x 750 kW

1 x 400 kW

1 x 250 kW

All Cummins engine output synchronous generators

Peak demand is estimated at:

Maximum during the days = 1200 kilowatts Minimum during the night = 650 kilowatts

During the day, when the peak exceeds 800 kilowatts of load, the demand is supplemented by the diesel generators. At night, the pattern of consumption does not require the diesel generators.

Method and Assumptions

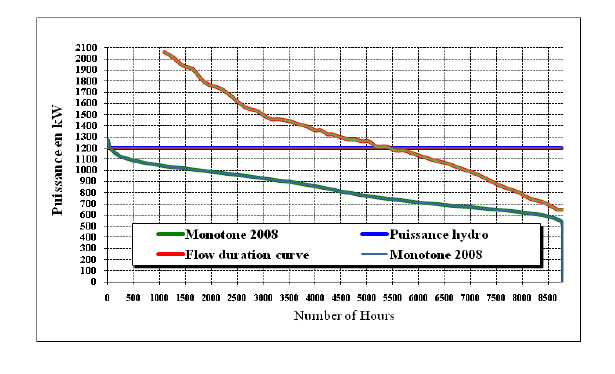

We use the monotonic load shown below for 2008 to give a possible annual hydro production of 7 000 000 kWh.

This number is calculated by subtracting the diesel production o 200 kW and using the 800 kilowatts of load, which imposes a de facto nominal power of 1000.

We deduce the load curve of total production by the triangle of 4500 hours on 200 kilowatts (see chart): (4500h x 200kw) / 2 = 450 000 kWh.

Assumptions

1 month full stoppage of the hydro to repair major damage to either the step-down transformers, the cell departure and arrival, or the transmission line.

This will reduce the hydro power supply to zero despite the potential dam capacity being available. Production will be based solely on the diesel generator on the basis of the average power of 900 kilowatts demand for 24hrs x 30days = 648 000 kWh

2 months a year period of low water flow causing a provision of 400 kilowatts a month, 600 kilowatts on the second month. This power demand must be supplied by the diesel generators which as above add 900 kilowatts per half day.

When the maximum hydro production is 400 kW the following diesel production is required: 500 kilowatts x 720 h / 2 = 180 000 kWh by diesel generation

When the maximum hydro production is 600 kW:

300 kilowatts x 720 h / 2 = 108 000 kWh by diesel generation

With the above assumptions the annual producible hydroelectricity is calculated as:

7 000 000 kWh (theoretical maximum)

- 450 000 kWh share of annual diesel

- 648 000 kWh due to major damage

- 288 000 kWh due to rainfall deficit.

= 5 614 000 kWh production annually by hydro.

------------------------------Page left intentionally blank -----------------------------

Utilities Regulatory Authority Vanuatu

You can access the Electricity Tariff Review Tariff Application Report March 2010 by referring to our website www.ura.gov.vu, contacting us by telephone (+678) 24945, fax (+678) 2308, email: [email protected] or writing to us at Office of Utilities Regulatory Authority, PMB 9093, Port Vila, Vanuatu.