No.06/02/2015-NEF/FRP

Government of India Ministry of Power

Shram Shakti Bhavan, Rafi Marg, New Delhi-110001

Dated: 20th November, 2015.

Office Memorandum

Sub: UDAY (Ujwal Discom Assurance Yojana) Scheme for Operational and Financial Turnaround of Power Distribution Companies (DISCOMs)

UDAY (Ujwal DISCOM Assurance Yojana), a Scheme for the Financial Turnaround of Power Distribution Companies (DISCOMs), has been approved by the Government of India with an objective to improve the operational and financial efficiency of the State DISCOMs.

2.0 This scheme shall apply only to State-owned DISCOMs. DISCOM for the purpose of this Scheme may include combined Generation, transmission and distribution Undertakings.

3.0 Participating States would undertake to achieve operational and financial turnaround of DISCOMs with measures outlined in the following paragraphs.

4.0 IMPROVING OPERATIONAL EFFICIENCY

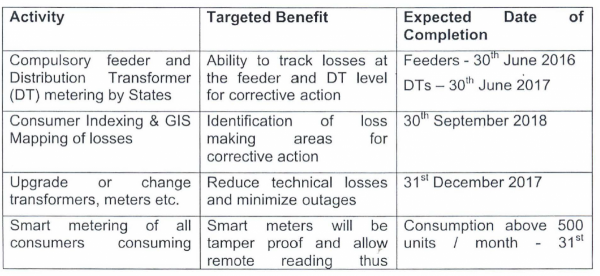

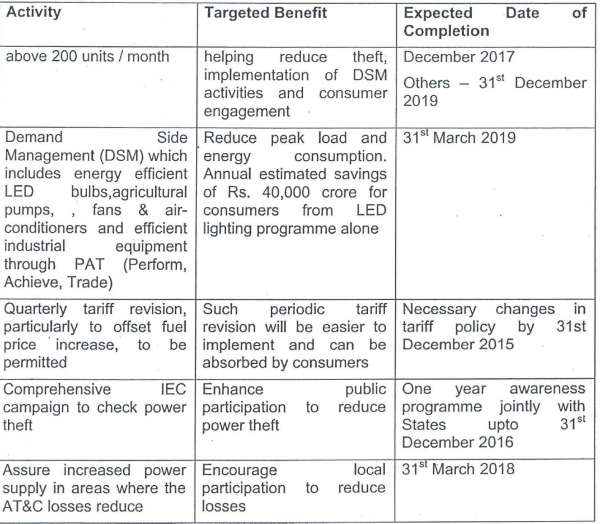

4.1 Participating States and utilities would follow the timeline of the following targeted activities for improving operational efficiencies.

4.2 In addition, participating States would develop State-specific targeted programmes for other activities to improve DISCOM efficiency as envisaged in '24X7 Power for All' Documents already prepared or under preparation.

4.3 Outcomes of operational improvements will be measured through following indicators:

a) Reduction of AT&C loss to 15% in 2018-19 as per the loss reduction trajectory to be finalized by Ministry of Power (MoP) and States, and

b) Reduction in gap between Average Cost of Supply (ACS) & Average Revenue Realized (ARR) to zero by 2018-19 as finalized by MoP and States. ·

5.0 REDUCTION OF COST OF POWER GENERATION

5.1 Both Gol and States will take steps to reduce cost of power.

5.2 To reduce the cost of Power, the GOI shall take steps for

(i) Increased supply of domestic coal;

(ii) Coal linkage rationalization;

(iii) Liberally allowing coal swaps from inefficient plants to efficient plants and from plants situated away from mines to pithead plants to minimize cost of Coal transportation;

(iv) Coal price rationalization based on Gross Calorific Value (GCV);

(v) Correction in Coal grade slippage through re-assessment of each mine;

(vi) Coal In'dia to supply 100% washed coal for G10 grade and above by

1st October 2018;

(vii) Supply of 100% crushed coal from Coal India by 1st April 2016;

(viii) Faster completion of transmission lines and adequate transmission by 31st March 2019, mostly through competitive bidding;

(ix) Allocation of coal linkages to States at notified price, based on which the State will go for tariff based bidding.

5.3 To reduce the cost of power, States shall take steps for

(i) Prospective power purchase through transparent competitive bidding by DISCOMs;

(ii) Improving efficiency of State generating units, for which NTPC would handhold.

6.0 AGREEMENT AND REVIEW

6.1 Agreement will be signed amongst State Government, DISCOMs and Government of India (Gol) stipulating responsibilities of State Government, DISCOMS and Got for achieving the operational and financial milestones, as described in the Scheme. Ministry of Power (MoP) may make suitable amendments to this agreement, if required.

6.2 MoP will devise a suitable review mechanism with representation from the Ministry of Finance (MoF) to ensure a close monitoring of performance on monthly basis to prevent any slippage.

7.0 SCHEME FOR FINANCIAL TURNAROUND

7.1 States shall take over 75% of DISCOM debt as on 30 September 2015 over two years - 50% of DISCOM debt shall be taken over in 2015-16 and 25% in 2016- 17.

a) States will issue non-SLR including SOL bonds in the market or directly to the respective banks I Financial Institutions (Fis) holding the DISCOM debt to the appropriate extent. Proceeds realised from issue of the bonds to the Banks I Fis shall be entirely transferred by the State to DISCOMs, which in turn shall discharge the corresponding amount of Banks I Fis debt.

b) Non-SLR bonds issued by the State will have a maturity period of 10-15 years with a moratorium on repayment of principal upto 5 years, as required by the State. '

c) The 10 year State bonds issued will be priced at 10 year G-Sec plus 0.5% spread for 10 year State bonds plus 0.25% spread for non-SLR status on semi annual compounding basis, or market determined rate, whichever is lower. This may be further reduced if interest is paid on monthly basis.

d) Banks I Fis shall not levy any prepayment charge on the DISCOM debt.

e) Banks I Fis shall waive off any unpaid overdue interest and penal interest on the DISCOM debt and refund I adjust any such overdue I penal interest paid since 1st October 2013.

f) Debt of DISCOM will be taken over in the priority of debt already due, followed by debt with highest cost.

g) The transfer to the DISCOM by the State in 2015-16 and 2016-17 will be as a grant. In case the State is not able to absorb the interest burden of the entire grant immediately, the transfer of grant can be spread over three years i.e. 25% in each of three years 2015-16 , 2016-17 and 2017-18 with the remaining transfer through State loan to DISCOM. For States with very high DISCOM debt, this period can be further relaxed by 2 years in consultation with MoP.

h) In exceptional cases, where DISCOM requires equity support, not more than 25% of this grant may be given as equity.

i) DISCOM debt to be taken over by the State will include DISCOM bonds which are committed to be taken over by the State as part of FRP 2012..

j) Any bonds already taken over in the financial year 2015-16 will also be covered as part of the scheme.

k) For amount transferred as loan, the interest rate payable by the DISCOMs to the State for the intervening period shall not exceed the rate of interest on the bonds issued by the State.

7.2 50% of DISCOM debt as on 30th September 2015, as reduced by any waivers under Para 7.1 e) abt>Ve, which will remain with the DISCOM by the end of 2015-16 shall be converted by the Banks/Fis into loans or bonds with interest rate not more than the bank's base rate plus 0.1%. Alternately, this debt may be fully or partly issued by the DISCOM as State guaranteed DISCOM bonds at the prevailing market rates which shall be equal to or less than bank base rate plus 0.1%. Half of this residual debt shall be taken over by the State in 2016-17 as indicated in Para 7.1 above. The States shall guarantee repayment of principal and interest payment for the balance debt remaining with DISCOM I bonds issued by DISCOM through an appropriate mechanism that will be developed by MoP in consultation with MoF.

7.3 Bonds to be issued against the loans of Fis, including REC and PFC, would first be offered for subscription by the market including pension and insurance companies. Balance, if any, will be taken over by banks in proportion to their current lending to DISCOMs.

7.4 Jharkhand and Jammu & Kashmir are given special dispensation to borrow Rs. 7,431 crore and Rs. 2,140 crore respectively to clear the provisional outstanding dues of various CPSUs as on 30th Sept, 2015 in the current financial year itself.

7.5 Oebt taken over by the State and borrowings by Jharkhand and J&K under this scheme would not be counted against the fiscal deficit limit of respective State in the financial years 2015-16 and 2016-17.

8.0 FINANCING OF FUTURE LOSSES & WORKING CAPITAL

8.1 States shall take over the future losses of DISCOMs in a graded manner and shall fund the loss as follows:

Year | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | ,4020,-21 |

Previous | 0% of the | 0% of the | 5% of the | 10% of | 25% of | 50% of |

Year's | loss of | loss of | loss of | the loss | the loss | the |

DISCOM | 2014-15 | 2015-16 | 2016-17 | of 2017- | of 2018- | previous |

loss to be | | | | 18 | 19 | year loss |

taken over | | | | | | |

by State | | | | | | |

The previous year's actual losses will be used for calculation for each year instead of using current year's estimated losses.

8.2 Henceforth, Banks/Fis shall not advance short term debt to DISCOMs for financing losses.

8.3 Current losses after 1st October 2015, if any, shall be financed only up to the extent of loss trajectory finalized by MoP with the State, and such financing will be done through State issued bonds or bonds issued by DISCOMs backed by State guarantee, to keep borrowing within limits and cost of borrowing low.

8.4 For working capital, Banks I Fis shall lend to DISCOMs only up to 25% of the DISCOM's previous year's annual revenue, or as per prudential norms.

8.5 For combined generation, transmission and distribution undertakings, Banks I Fis may provide upto 25% working capital for distribution business and for the remaining business, Banks I Fis may take their own decision as per prudential norms. Wherever possible, this need based working capital may be granted by way of Letters of Credit to further bring down cost of capital.

8.6 States should ensure that entire cost of State owned generation and transmission undertakings is recovered.

9.0 DISCOMs opting for the scheme will comply with the Renewable Purchase Obligation (RPO) outstanding since 1st April, 2012, within a period to be decided in consultation with MoP.

10.0 Participating States may get additional I priority funding through DDUGJY, IPDS, Power Sector Development Fund (PSDF) or other such schemes of MoP and Ministry of New and Renewable Energy (MNRE), ,if they meet the operational milestones outlined in the Scheme. Such States shall also be supported with additional coal at notified prices and, in case of availability, through higher capacity utilization, low cost power from NTPC and other Central Public Sector Undertakings (CPSUs). States not meeting operational milestones will be liable to forfeit their claim on IPDS & DDUGJY grants.

11.0 Benefits provided in the FRP 2012 for capital reimbursement support shall not be available under the proposed scheme. ·

12.0 Operational guidelines relating to para 6.2 & 7.2 and any other guidelines, as required, will be issued separately by MoP.

13.0 The scheme is optional for the States. However, States are encouraged to. take the benefit at the earliest as benefits are dependent on the performance.

14.0 This issues with the approval of the Competent Authority.

(A. K. Verma) Joint Secretary to the Govt of India

To:

- Secretary, Ministry of Finance, Department of Expenditure, North Block, New Delhi.

- Secretary, Ministry of Finance, Department of Economic Affairs , North Block, New Delhi.

- Secretary, Ministry of Finance, Department of Financial Services, Jeevan Deep Building, New Delhi with a request to circulate this OM to Banks/Fis

- Secretary, Ministry of Finance, Department of Revenue, North Block, New Delhi.

- Secretary, Ministry of Coal, Shastri Bhavan, New Delhi.

- Secretary, Ministry of New & Renewable Energy, Block No.14, CGO Complex, Lodhi Road, New Delhi.

- The CEO, NITI Aayog, New Delhi.

- The Chairman Railway Board, Rail Bhawan, New Delhi.

- Governor, Reserve Bank of India, Mumbai.

Copy to:

- Prime Ministers Office (Joint Secretary Shri A K Sharma) South Block, New Delhi

- Cabinet Secretariat (Joint Secretary Smt Deepti Umashankar), Rashtrapati

Bhawan, New Delhi

- Chief Secretaries of all States ,.

- Principal Secretary Power/Energy of all States and UTs

- Principal Secretary Finance of all States and UTs

- Chairperson, CEA, New Delhi

- CMD, REC, New Delhi

- CMD, PFC, New Delhi

Copy also to, for information

(i) PS to MOSP(IC)

(ii) PPS to Secretary (P).

(iii) PPS to AS(BNS)/PPS to AS(BPP).

(iv) PS to JS(Distribution)/ JS&FA/JS(Thermal)/JS(Trans .)/ JS(Hydel)/ JS(IC)

(V) PPS to Director (D) ;

(VI) Budget Section/Finance Division

(VII) Controller of Accounts, Seva Bhavan, R.K. Puram, New Delhi.

(VIII) Technical Director, NIC, MoP: with the request to upload the OM on t Website of the Ministry

(Narender Singh)

Under Secretary to the Govt of India